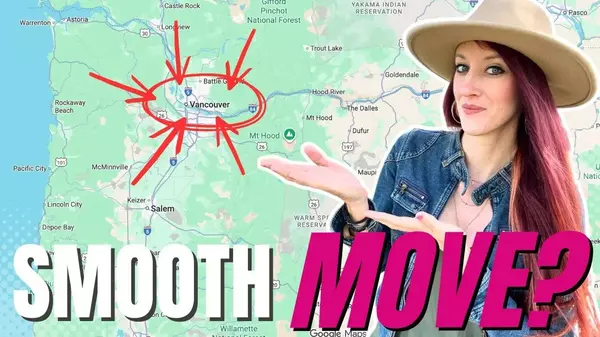

New Short-Term Rental Regulations in Vancouver, WA: What You Need to Know for 2024

Investing in Vancouver, Washington's real estate just got a bit trickier as of January 1st, 2024. Don’t worry, it’s not the end of short-term rentals, but it is something to consider if you're planning to use your property as a short-term rental. So, let’s dive into what’s new!

New Short-Term Rental Regulations in Vancouver, WA: What You Need to Know for 2024

Hi there, I’m Cassandra Marks, also known as Realtor Cas, your go-to guide for everything Southwest Washington, Clark County, Vancouver, and even Portland. I’m both a local and national investor, so I’ve got you covered. If you have any questions or are considering purchasing or investing in these areas, shoot me an email, text, or DM on social media at Realtor Cas. Let’s talk about your goals!

New Short-Term Rental Regulations

Starting January 1st, 2024, the City of Vancouver is accepting permit applications for its new short-term rental pilot program. Here’s what you need to know:

Definition of a Short-Term Rental:

A residential property or part of it (like a room, guest house, ADU, etc.) available for rent for stays less than 30 days. This includes rentals on platforms like Airbnb and VRBO.

What is NOT Considered a Short-Term Rental:

- A dwelling unit rented for fewer than 30 consecutive days isn’t considered a hotel, motel, or bed and breakfast.

- A property occupied by the owner for at least six months a year with fewer than three rooms rented at any time.

- A property rented to the same person for 30 or more consecutive days.

- A property operated by a registered charitable organization.

Examples

Owner-Occupied Property:

If you live in your home for more than six months a year and rent it out for the rest, it does not qualify as a short-term rental needing a permit.

ADU Rented for 30+ Days:

Renting an ADU in one-month increments to people like traveling nurses does not require a short-term rental permit.

ADU Rented for Short Stays:

An ADU with four bedrooms rented for three nights at a time does require a permit.

Permit Process

Until now, the city’s land use and development code didn’t allow short-term rentals in residential zones except as bed and breakfasts. Here’s how to get your short-term rental permit:

Research and Preparation:

Ensure your property is within Vancouver city limits.

Obtain a Washington state business license and a City of Vancouver business license.

Get at least $1 million in liability insurance.

Notify your neighbors with a detailed letter about your rental.

Complete the Application:

Fill out the short-term rental permit form, including all necessary documents (letters, insurance, etc.).

Pay the Fees:

Submit your application and pay the $250 one-time permit fee.

Approval and Posting:

If approved, you’ll receive a permit number and certificate to post at your rental property.

Program Goals and Monitoring

The pilot program will run for 24 months to assess its effectiveness. The city aims to:

- Limit short-term rentals to 870, preserving housing for long-term residents.

- Exclude short-term rentals from developments receiving multifamily tax exemptions.

- Ensure ongoing compliance and monitor impacts on housing affordability, public safety, and community well-being.

- Letters were sent to 425 current short-term rentals within city limits, explaining the new regulations and permit process.

- The limit is 870 permits, so if you’re considering a short-term rental, act quickly!

The Big Picture

Short-term rentals have grown in popularity in the Pacific Northwest, including Vancouver. However, this new regulation is a step to balance the needs of long-term residents and investors. Always do your due diligence and stay updated, as the rules may change after the trial period.

If Vancouver’s new regulations feel too restrictive, check out my video on the six suburbs of Vancouver where you might find great opportunities.

I hope you found this information helpful. I’m Cassandra Marks, aka Realtor Cas, and I’m here to help with all your real estate needs. Thanks for spending time with me today. Until next time, take care!

If you want more information, here are some direct sources about short-term rentals in Vancouver:

City of Vancouver: Now Accepting Short-Term Rental Permit Applications:

City of Vancouver Community Development: Short-Term Rentals:

Sign up for my monthly newsletter to receive expert advice, important local updates, and insider knowledge on the best ways to thrive in this unique region. Whether you're buying, selling, or simply curious about life in the Pacific Northwest, I've got you covered.

👉 Join my newsletter today and never miss a beat! Just enter your email below and get exclusive access to all things Southwest Washington. Let’s stay connected!

Frequently Asked Questions

What are the rules for short-term rentals in Vancouver, WA?

Short-term rentals are allowed under Vancouver’s pilot program. Hosts must live on the property, obtain city and state business licenses, a short-term rental permit, carry liability insurance, and notify neighbors.

Is Airbnb legal in Vancouver, WA?

Yes, but only if you comply with local regulations. Hosts must register, obtain permits, and follow zoning and safety standards.

Are short-term rentals allowed in Clark County, WA?

Yes, but rules vary. Properties inside Vancouver city limits follow city regulations, while others in unincorporated areas may have different requirements.

Do I need a business license for a short-term rental in Washington?

Yes. You’ll need a Washington State business license and a city-specific business license for your rental location.

Can I rent out my basement suite on Airbnb in Vancouver, WA?

Yes, if it’s part of your primary residence and meets zoning, health, and safety requirements.

What is the 90-day Airbnb rule?

There’s no 90-day limit in Vancouver, WA. The city does require the unit to be your primary residence and to be properly permitted.

What is the short-term rental tax rule in Washington?

Short-term rentals must collect and remit lodging and sales taxes. Platforms like Airbnb may do this automatically, but hosts are responsible for compliance.

Do I have to pay taxes on Airbnb income in Washington?

Yes. Rental income is taxable and may also be subject to business and occupation (B&O) taxes.

Can I start a short-term rental business with no money?

Unlikely. Startup costs include licenses, insurance, furnishings, and compliance upgrades.

What is the 7-day rule in short-term rentals?

There is no 7-day rule in Vancouver, WA. Stays under 30 days are considered short-term rentals and subject to specific regulations.

Categories

Recent Posts

GET MORE INFORMATION

Cassandra Marks

Realtor, Licensed in OR & WA | License ID: 201225764

Realtor, Licensed in OR & WA License ID: 201225764