2024 Housing Market Flatlines in Vancouver, WA: Insights and 2025 Outlook from a Local Realtor

2024 Housing Market Flatlines in Vancouver, WA: Insights and 2025 Outlook from a Local Realtor

As we ring in 2025, it's that time again to take a step back, put on our real estate expert hats (or, in my case, a farmer’s hat with a real estate problem), and revisit the predictions made about the 2024 housing market in Vancouver, Washington. It’s like checking in on your New Year’s resolutions—did we hit the mark, or did we miss the target completely? And more importantly, what do we think the 2025 market has in store for buyers, sellers, and curious real estate enthusiasts like yourself?

Let’s dive into the numbers, predictions, and trends that shaped 2024. Grab your coffee, and let’s go!

2024 Housing Market: The Year of Predictions, Surprises, and Keeping It Real

2024 started off with high hopes and hefty predictions about the housing market. Experts across the nation predicted a variety of trends: modest home price growth, a slight increase in sales, and—hopefully—some relief on those sky-high mortgage interest rates. I, your friendly local real estate expert (a.k.a. Realtor Cass), had my own thoughts on how things would unfold in Southwest Washington. And guess what? I was kind of right… but also not.

Home Values: How Did We Do?

First things first—let’s talk about home prices. Everyone wants to know how much equity they gained or lost in 2024. Was this the year of skyrocketing values, or did we hit a plateau?

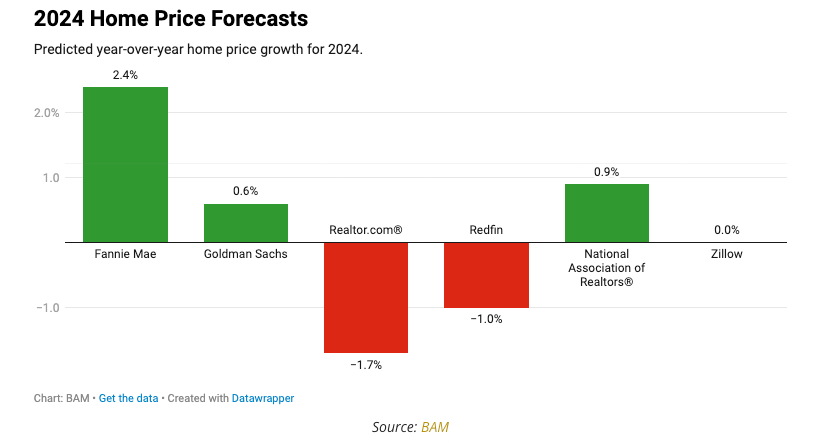

According to NAR Chief Economist Lawrence Yun, we were looking at a moderate price increase of about 2% year-over-year. My prediction? A little more optimistic, with a 3-4% increase. So, what actually happened? Well, despite the Federal Reserve cutting rates three times in 2024, we ended the year with higher interest rates than we started with. But, surprise, surprise—home prices didn’t follow suit and decline.

The national median home price actually saw a 3.9% increase, and here in Southwest Washington, we experienced a 2.9% appreciation. That means the average home price in Vancouver WA climbed to $540,000 by December 2024—an increase that reflects growing demand. Home values in Vancouver WA remain resilient despite high mortgage rates, echoing broader real estate trends across the region.

What about the “big players”? Well, Redfin and Realtor.com, and real estate platforms like Zillow, which all offer real-time listings and market data— predicted a decline of 1% and 1.7%, respectively, but, as we all know, they’ve been off the mark for the last two years. And Fannie Mae? They predicted a 2.4% increase, and we ended up with 2.9%. It’s safe to say they all missed the mark in one way or another, but at least I’m a little closer to the mark than those giant real estate giants!

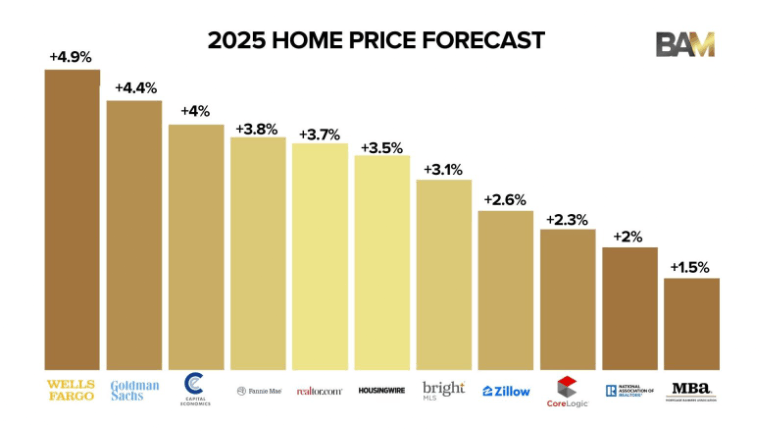

Looking ahead to 2025, economists are predicting mild home appreciation—somewhere between 1.5% and 4.9%. Zillow forecasts 2.6% growth, while Realtor.com is a bit more bullish with a 3.7% increase. Personally, I’m leaning toward a solid 3-4% increase, especially with demand still high, rates above 7%, and a growing influx of people moving northward due to rising temperatures and natural disasters affecting other areas.

Home Sales Volume: More Homes for Sale, But Not Enough

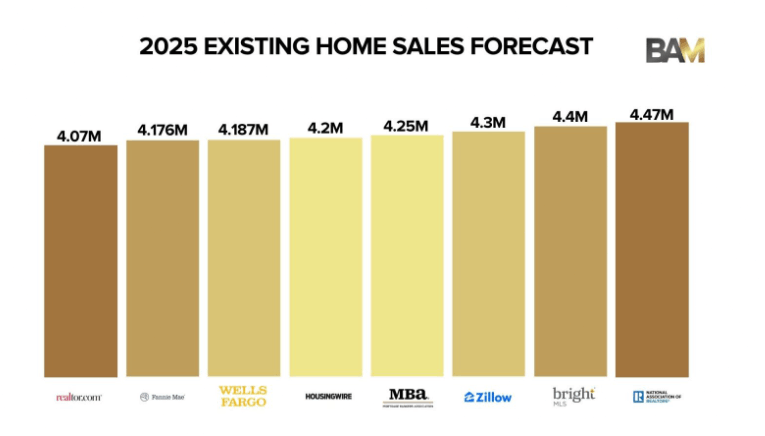

Now, let’s talk about sales volume. Were we going to see more homes sold in 2024? The experts, including Lawrence Yun and others, predicted that we would see around 4 million homes sold nationally. I was a bit more optimistic and thought we’d see an uptick, but nothing huge.

Guess what? We ended up with about 4.15 million units sold—an increase, but not enough to fill the demand. Here in Southwest Washington, the inventory was up 99.2% in listings year-over-year, with 8.6% more homes sold. But, here's the kicker: the inventory is still low compared to pre-recession levels. So, we’re still facing that tight inventory problem that’s been plaguing the market for years now.

Why? A significant factor is that over 50% of homeowners with mortgages have interest rates below 5%, and many simply can’t stomach the idea of selling and trading their low-rate mortgage for a higher one. This has created a bit of a “lock-in” effect.

Looking ahead to 2025, we’re expecting sales to climb slightly, with predictions ranging from 4.0 to 4.47 million units. This is great news for buyers and sellers, but it won’t quite meet the demand. With the Baby Boomer generation beginning to downsize (they’re hitting that 65+ age bracket), we might see a bit more inventory hit the market, which could help. But I think we’re still looking at an inventory crisis until 2030-2035.

Mortgage Interest Rates: The Never-Ending Rollercoaster

Ah, mortgage rates—the topic that’s been a hot-button issue for the last couple of years. In 2023, rates ended the year around 6.61%. Experts were all predicting that rates would stay below 7% in 2024, with some even hoping for a drop back below 6%. As we all know by now, those predictions didn’t quite pan out.

By the end of 2024, we were still hovering above 7%. Despite the Federal Reserve’s three rate cuts, mortgage rates remained stubbornly high. Why? Well, the law of supply and demand is real, my friends. People still need homes, and the lack of inventory is keeping those rates elevated. You might’ve been hoping for a better drop, but unfortunately, the affordability issues persist.

The big question now is what will happen in 2025. My prediction? We’ll see rates stay flat around 7%. They won’t likely dip below that anytime soon, but I’d be thrilled to be proven wrong!

Home Affordability: Can We Still Afford It?

Let’s talk about affordability—because let’s face it, we all want to know if we’re going to be able to afford that dream home anytime soon.

The typical entry-level home in the Vancouver-Portland market in 2024 was around $450,000. But here’s the kicker: as interest rates rise, buying power drops. For example, if you’re approved for a $450,000 home at a 6% interest rate and the rate jumps to 7%, your buying power decreases by about $40,000. If rates climb to 8%, as we saw briefly in October 2023, you’re down another $40,000 in buying power. So, affordability is getting squeezed.

But don’t lose hope just yet. We might see new construction offers some relief. Builders are offering incentives (hello, low interest rates!) to attract buyers, with some offering up to $30,000 in incentives to help bring that interest rate back down closer to 5% or 6%. If you’re in the market for a new home, it could be a great option, but make sure to work with a realtor who knows the ropes.

Looking Ahead to 2025: What’s Next for the Vancouver, WA Housing Market?

Alright, now let’s talk about what’s coming in 2025. Based on everything I’ve seen and experienced this past year, here’s what I predict:

- Home Prices: I’m expecting average appreciation to hover around 3-4% in 2025. We’ll see mild growth, but nothing too extreme.

- Sales Volume: As more people get fed up with waiting for rates to drop, I think we’ll see more homes hit the market, especially as Baby Boomers start downsizing.

- Interest Rates: I’m predicting that rates will stay flat around 7% for the foreseeable future. I’d love to see them drop, but I think we’re in for more of the same.

- Buyer Behavior: Buyers will continue to be picky, demanding move-in-ready homes and making sure all inspections are in place. Multiple offers will still happen, but only for well-priced homes.

- Negotiations: Buyers will continue to have leverage in negotiations, especially if a seller is pricing a home too high.

Final Thoughts on Housing Market in Vancouver WA

The 2024 housing market in Vancouver, WA was full of surprises and slight disappointments. While some predictions fell short, others were spot on. As we look to 2025, the housing market here is likely to remain tight, with slightly increased home prices and more homes for sale—but still not enough to meet demand.

If you’re thinking about buying or selling in 2025, reach out! As a local real estate expert with years of experience, I can help you navigate the market, whether you're relocating to the area, downsizing, or just looking for that perfect home.

Visit our website today to get started on your journey to homeownership!

Sign up for my monthly newsletter to receive expert advice, important local updates, and insider knowledge on the best ways to thrive in this unique region. Whether you're buying, selling, or simply curious about life in the Pacific Northwest, I've got you covered.

👉 Join my newsletter today and never miss a beat! Just enter your email below and get exclusive access to all things Southwest Washington. Let’s stay connected!

Frequently Asked Questions

Are housing prices dropping in Vancouver?

Not significantly—housing prices in Vancouver, WA remain stable or slightly up. As of early 2025, the median listing price was around $550,000, with modest year-over-year growth. The market is cooling slightly, giving buyers more leverage than in previous years.

Is Vancouver, WA a buyers or sellers market?

Vancouver is still considered a seller’s market, but it's trending toward a more balanced position. Inventory is increasing and competition is easing, which gives buyers more negotiating power. Homes are still selling, but not as aggressively over asking as before.

Is there a housing shortage in Vancouver WA?

Yes, Vancouver is experiencing a housing shortage, especially in the affordable and rental markets. Demand continues to outpace supply due to steady in-migration and slow construction. This imbalance contributes to rising home prices and rent.

How many offers are houses getting in Vancouver, WA?

In-demand homes may still receive multiple offers, especially if priced well and in a desirable neighborhood. However, bidding wars are less intense than during the pandemic boom. On average, homes are now taking longer to sell, ranging from 13 to 58 days.

Why is Vancouver getting so expensive?

Vancouver’s rising housing costs are driven by strong demand, limited inventory, and its proximity to Portland without the Oregon income tax. Its popularity with remote workers, retirees, and commuters keeps the pressure on prices. Inadequate zoning changes and slow development also contribute to affordability challenges.

Where is the best place to live in Vancouver, WA?

Some of the most popular neighborhoods include Felida, Fisher’s Landing, Cascade Park, and North Image. These areas are known for good schools, safety, and community amenities. Each offers a unique balance of suburban comfort and accessibility.

What is the housing crisis in Vancouver?

The housing crisis in Vancouver stems from a combination of high demand, limited new construction, and rising costs. Many local residents are being priced out of both ownership and rental markets. This impacts first-time buyers, low- to moderate-income families, and long-time renters most severely.

Why is Vancouver, Washington so popular?

Vancouver offers scenic views, a walkable riverfront, no state income tax, and a lower cost of living compared to nearby Portland. It’s family-friendly, business-friendly, and full of outdoor recreation opportunities. These factors make it attractive to new residents from across the region.

Why are people moving out of Vancouver?

Some residents leave Vancouver due to rising home prices, higher rents, and increased traffic. Others seek more space, lower costs, or job opportunities in other cities or states. While Vancouver is growing overall, affordability concerns are prompting some to relocate.

What are the cons of living in Vancouver, Washington?

Vancouver faces rising housing costs, a growing homeless population, and increasing traffic congestion. The real estate market is competitive, and rental availability is tight. Some residents feel the pace of growth is outstripping infrastructure and local services.

Categories

Recent Posts

GET MORE INFORMATION

Cassandra Marks

Realtor, Licensed in OR & WA | License ID: 201225764

Realtor, Licensed in OR & WA License ID: 201225764