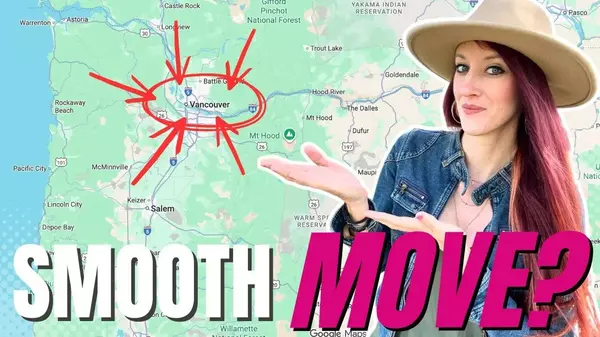

Common Mistakes to Avoid When Buying a Home in Vancouver, WA

Common Mistakes to Avoid When Buying a Home in Vancouver, WA

Buying a home is an exciting milestone in life, but it can also be overwhelming, especially for first-time homebuyers. Vancouver, WA, offers a lot of charm and opportunity, but the home-buying process comes with its own set of challenges. To make sure you don’t get caught in common pitfalls, I’m sharing the most frequent mistakes that people make when buying a home in Vancouver and how you can avoid them.

Whether you're buying your first home or are a seasoned buyer, these tips will help you navigate the Vancouver real estate market like a pro. Let's dive in!

1. Not Getting Pre-Approved for a Mortgage First

Why it Matters:

Starting the homebuying process without a mortgage pre-approval is like trying to shop without knowing how much money you have to spend. You might fall in love with a home that’s way out of your price range—or worse, waste precious time and energy looking at houses you can’t actually buy. In a competitive market like Vancouver, WA, sellers expect buyers to come prepared. Without a pre-approval letter in hand, your offer may not even be taken seriously.

A pre-approval gives you a clear understanding of how much you can borrow based on your income, credit score, debts, and assets. It allows you an idea of what you might expect for an interest rate for a period of time, protecting you if rates rise while you shop.

How to Avoid It:

Before you even open a real estate app or schedule your first showing, take the time to get pre-approved. Here's what the process usually looks like:

-

Gather Your Financial Documents: Lenders will typically ask for proof of income (like W-2s and pay stubs), tax returns, bank statements, and information on any debts you have (like car loans or student loans).

-

Shop for a Lender: Not all lenders offer the same rates or services. Compare a few to see who can give you the best deal, and who makes you feel comfortable during the process. Local lenders in Vancouver, WA often have a better understanding of the market compared to big online companies. I have a list of questions for lenders and a list of highly vetted lenders to recommend because not all lenders are created equal.

-

Submit Your Application: Once you've chosen a lender, you'll submit an application and provide your financial documents. They'll review everything and let you know how much they're willing to lend you.

-

Receive Your Pre-Approval Letter: This letter states the amount you're approved to borrow and can be shown to sellers when you make an offer.

Remember: Pre-approval is different from pre-qualification. A pre-qualification is just an estimate based on what you tell the lender. A pre-approval is based on verified financial information—and carries a lot more weight when you’re negotiating on a home.

Pro Tip:

If you're self-employed or your financial situation is a little complicated, getting pre-approved can take a bit longer. Start early and stay patient! Having everything ready upfront can save you a lot of headaches (and heartaches) later.

2. Skipping the Mortgage Shopping Process

Why it Matters:

Getting pre-approved for a mortgage is a huge first step—but what many first-time homebuyers don’t realize is that not all mortgage offers are created equal. It can be tempting to accept the first mortgage you're offered, especially when you’re excited to start house hunting. But if you don’t shop around, you could end up locking yourself into a higher interest rate or less favorable terms than you deserve.

Even a small difference in your interest rate can add up to thousands of dollars over the life of your loan. In a competitive market like Vancouver, WA, every dollar matters when it comes to staying within your budget and setting yourself up for financial success.

When you’re buying a home in Vancouver, WA, mortgage rates can vary significantly between lenders. This is why it’s important to compare offers from multiple lenders. Check out the market snapshot report for Vancouver, WA to see how current values compare and how this might affect your mortgage options.

How to Avoid It:

-

Talk to Multiple Lenders: Don’t settle for the first quote you get. Banks, credit unions, and private lenders all offer different mortgage rates and terms. Compare at least three or four options to get a sense of what's available.

-

Use a Mortgage Broker: If you’re feeling overwhelmed by the idea of shopping around, a mortgage broker can do the heavy lifting for you. They have access to multiple lenders and can often find you a better rate than what you'd get on your own. A good broker will also explain the fine print so you know exactly what you're agreeing to.

-

Look Beyond Just the Interest Rate: It’s easy to focus only on the interest rate, but make sure you're also comparing things like:

-

Loan terms (15 years, 30 years, etc.)

-

Fixed vs. adjustable rates

-

Prepayment penalties

-

Closing costs

-

Mortgage insurance requirements

-

-

Get Pre-Approved, Not Just Pre-Qualified: A pre-approval shows sellers you’re serious and gives you a much clearer picture of your budget. It’s a stronger position than just being pre-qualified, which is often a rough estimate based on limited information.

Pro Tip:

Ask each lender for a Loan Estimate form. This standardized document breaks down the costs, fees, and terms of the mortgage, making it much easier to compare offers side-by-side.

Why It’s Worth It:

Spending a few extra days shopping for the right mortgage can literally save you tens of thousands of dollars over the life of your loan—and could even be the difference between affording your dream home or having to settle for less.

Remember: you’re the customer. Don’t be afraid to ask questions and negotiate for better terms!

3. Overextending Your Budget

Why it Matters:

When you finally find the one — that dream home with the perfect kitchen, the big backyard, and the cozy fireplace — it’s easy to get caught up in the excitement. You might start thinking, "It’s only a little more than we planned…we can make it work, right?"

But stretching your budget too far can create serious problems down the road. Homeownership comes with a lot of hidden costs—and if you’re already maxed out just making the mortgage payment, even small unexpected expenses (like a broken water heater or a surprise property tax increase) can throw your finances into chaos.

Plus, living paycheck to paycheck to afford a house can quickly take the joy out of owning it.

How to Avoid It:

-

Stay Within Your Pre-Approved Limit: Your mortgage pre-approval tells you the maximum amount a lender is willing to loan you—not necessarily what you should spend. Often, it’s smarter to buy below your max approval, so you have breathing room.

-

Factor in the Full Cost of Homeownership: Beyond your monthly mortgage payment, make sure your budget includes:

-

Property taxes

-

Homeowner’s insurance

-

Utilities (which might be higher than what you're used to)

-

HOA fees (if applicable)

-

Regular maintenance and repairs

-

Future upgrades you might want to make

-

-

Follow the 28/30 Rule: A safe guideline is to keep your total monthly housing costs (mortgage, taxes, insurance, etc.) to no more than 28-30% of your gross monthly income. If you go much higher, you risk becoming “house poor” — where most of your money goes to your home and you have little left for savings, vacations, emergencies, or just enjoying life.

-

Be Realistic About Lifestyle Changes: If you’re barely able to afford the house and you’re hoping to remodel, travel, or start a family soon, it’s time to take a step back. Make sure you’re buying a home that fits both your current budget and your future goals.

Pro Tip:

Before making an offer, sit down and run the numbers—not just on the mortgage, but on everything. Plan for worst-case scenarios too, like job changes, unexpected repairs, or higher utility bills during winter. If the numbers still make sense and leave you a comfortable cushion, you’re in good shape!

4. Not Hiring the Right Real Estate Agent

Why it Matters:

In today’s world of online listings and DIY tutorials, it’s easy to think, "I can find a home myself and save some money." But buying a home — especially in a competitive market like Vancouver, WA — is about way more than just finding a pretty house online.

A good real estate agent acts as your guide, negotiator, and advocate through every part of the process. They can help you avoid costly mistakes, spot red flags you might miss, and even uncover homes that aren’t widely listed yet. After the NAR lawsuit settlement we are still seeing sellers offer compensation to buyers agents but no in every case. This is now just a larger negotiation point in the buyers offer on the purchase and sale agreement and something a good agent will talk with you about before you start shopping for your new home.

Without a professional on your side, you risk:

-

Overpaying for a property

-

Missing important contract details

-

Overlooking hidden issues with the home

-

Getting lost in piles of confusing paperwork

-

Losing out on better opportunities

How to Avoid It:

-

Work with a Local Expert: Choose an agent who knows Vancouver, WA inside and out. Local agents understand neighborhood trends, school districts, commute times, and hidden gems that you might miss just browsing online.

-

Ask Good Questions: When interviewing agents, ask about their experience with buyers like you (first-timers, upsizers, relocators, etc.). Make sure they have a strong network of inspectors, lenders, and contractors too.

-

Trust Their Expertise: A great agent will not only show you homes, but also point out potential problems (like signs of water damage or foundation cracks) and help you think long-term about resale value and neighborhood growth.

-

Let Them Handle the Hard Stuff: Your agent will negotiate on your behalf, explain confusing legal documents, and help you keep track of all the deadlines and paperwork involved. This takes a huge amount of pressure off you, so you can focus on picking the right home — not stressing over the fine print.

Pro Tip:

Even if you find a house on your own, always have your agent communicate with the seller’s agent. They’ll make sure your interests are protected and help you craft a strong, competitive offer — which can make all the difference in a hot market like Vancouver!

5. Forgetting About Closing Costs

Why it Matters:

You’ve saved for the down payment, you’ve gotten pre-approved for a mortgage, and you’ve found the perfect home in Vancouver, WA — you’re ready to go, right? Not quite yet! Many homebuyers forget to plan for closing costs, and it can throw a serious wrench in your plans if you're not prepared.

Closing costs are the additional expenses you’ll need to pay at the time you finalize (or "close") your home purchase. They’re separate from your down payment and can include:

-

Home inspection fees

-

Appraisal fees

-

Title search and title insurance

-

Loan origination fees

-

Recording fees

-

Escrow fees

-

Prepaid property taxes and homeowners insurance

-

Attorney fees (if applicable)

In Vancouver, WA, closing costs typically range from 2% to 5% of the home's purchase price, according to the Consumer Financial Protection Bureau. That means if you're buying a $500,000 home, you could owe anywhere from $10,000 to $25,000 at closing — on top of your down payment.

If you don’t plan for these costs, you could find yourself scrambling for cash at the last minute or risk delaying (or even losing) your home purchase.

How to Avoid It:

-

Budget Early: When calculating how much house you can afford, include estimated closing costs right from the beginning. Don't just focus on the down payment!

-

Ask for a Loan Estimate: Early in the process, your lender should provide you with a Loan Estimate — a detailed document outlining your expected closing costs. Review it carefully and ask questions if anything is unclear.

-

Negotiate Wisely: Sometimes, you can negotiate for the seller to cover part (or even all) of your closing costs. This is called a seller concession. An experienced real estate agent (like me!) can help you strategize when it makes sense to ask for this.

-

Shop Around: Some services (like title insurance or home inspections) might be flexible, so you can shop around for better prices and possibly save a few hundred dollars.

-

Keep a Little Extra: Always save a little more than the estimated amount just in case. It’s better to have extra funds than to come up short.

Pro Tip:

Some first-time homebuyer programs and loan options may help reduce your closing costs or roll them into your mortgage. Be sure to ask your lender or real estate agent about any programs you might qualify for!

6. Failing to Consider the Neighborhood

Why it Matters:

It’s easy to fall in love with a home — the updated kitchen, the beautiful backyard, the spacious primary bedroom — but remember: you’re not just buying a house, you’re buying into a community. The neighborhood you choose can make or break your experience living there. Even the most perfect house won’t feel like home if the neighborhood doesn’t match your lifestyle or expectations.

Things like noise levels, commute times, safety, access to parks, schools, shopping, and even how friendly the neighbors are can hugely impact your overall happiness. Skipping neighborhood research can lead to regrets later, especially in a place like Vancouver, WA, where neighborhoods can vary a lot in vibe, amenities, and price.

How to Avoid It:

-

Visit at Different Times: Check out the neighborhood morning, afternoon, and evening to get a full picture. A quiet street at 10 AM might be a different story at 10 PM.

-

Drive (or Walk) Around: Explore nearby parks, grocery stores, restaurants, and other amenities. Pay attention to traffic patterns, street parking, and overall cleanliness.

-

Research Schools: Even if you don't have kids, good schools often mean higher property values and a stronger resale market.

-

Talk to Neighbors: If you can, chat with a few residents. They can give you honest insights about what it’s really like to live there.

-

Check Safety and Crime Stats: Look up online reports for crime rates in the area or ask your real estate agent for local knowledge. Feeling safe in your neighborhood is priceless.

-

Think About Your Lifestyle: Do you want a walkable neighborhood? Quick access to freeways for commuting? Close proximity to hiking trails, dog parks, or coffee shops?

Make sure the area fits your daily routine and priorities — not just now, but for the years you plan to live there.

Pro Tip:

Create a checklist of your "must-haves" for a neighborhood — just like you would for the house itself. This helps keep you focused when emotions start running high during house tours!

Curious about why Vancouver is an ideal place to live in the long term? If you’re considering settling here for retirement, check out 5 Reasons to Retire to Vancouver, Washington in 2025.

7. Underestimating Maintenance and Repairs

Why it Matters:

Buying a home isn't just about making the purchase — it’s about keeping it in good shape over the years. Even if you score a brand-new house or a recently renovated one, regular maintenance is part of being a homeowner. Things like fixing leaky faucets, replacing worn-out roofs, cleaning gutters, updating appliances, or repairing HVAC systems will eventually pop up — and those costs can add up if you’re not ready.

A lot of buyers focus so much on the upfront costs (down payment, closing costs, moving expenses) that they forget to plan for what happens after move-in day. Without a maintenance budget, unexpected repairs can turn into financial headaches and even threaten your ability to stay on top of mortgage payments.

How to Avoid It:

-

Budget for Maintenance: A common rule of thumb is to save 1% to 3% of your home’s value each year for maintenance and repairs.

For example, if your home costs $400,000, plan to set aside $4,000 to $12,000 annually, depending on the home's age and condition. -

Get a Thorough Home Inspection: Before buying, have a professional home inspector check everything — roof, foundation, plumbing, electrical systems, and more.

The inspection will help you spot potential issues early and give you a realistic idea of what repairs might be needed soon. -

Plan for Big Replacements: Major components like roofs, HVAC systems, and water heaters have limited lifespans. Knowing when these systems might need replacing helps you avoid being blindsided by huge expenses.

-

Create a Maintenance Schedule: Stay ahead of repairs by regularly checking important systems and doing seasonal maintenance. Small fixes now can prevent bigger (more expensive) problems later.

Pro Tip:

Ask the seller for a list of recent repairs and warranties on major appliances or systems.

It’ll give you an idea of what’s new, what’s older, and what you might need to budget for in the near future.

Related Reading:

Curious about what's happening in the Vancouver housing market right now?

Check out my update on the 2024 housing market in Vancouver, WA — it might help you plan your homebuying strategy better!

FAQs about Common Mistakes to Avoid When Buying a Home in Vancouver, WA

What is the best time to buy a home in Vancouver, WA?

The best time to buy a home in Vancouver is typically during the spring and summer months when inventory is higher and the weather is more favorable. However, the winter months can offer lower prices and less competition, which might be a good opportunity if you're willing to navigate the cold.

How much should I budget for closing costs in Vancouver, WA?

Closing costs usually range from 2% to 5% of the home's purchase price. It's important to plan for these expenses early on so you're not caught off guard at the end of the process.

How do I find a good real estate agent in Vancouver, WA?

Start by asking friends or family for recommendations. Look for agents who are experienced in the Vancouver area and have a good track record. Check their online reviews and make sure you feel comfortable working with them.

How long does it take to buy a home in Vancouver, WA?

The home-buying process typically takes about 30 to 45 days, but it can be shorter or longer depending on your situation. Having your mortgage pre-approved and a real estate agent on your side can help speed things up.

About Cassandra Marks

As a local real estate expert, I’ve helped countless clients buy and sell homes in the Vancouver, WA area. Whether you're a first-time buyer or an experienced investor, I’m here to guide you through every step of the process. I specialize in making your home-buying experience smooth and stress-free, so you can focus on what matters most – finding your dream home.

If you're ready to get started, don’t hesitate to reach out! Let’s make your home-buying journey a success.

Sign up for my monthly newsletter to receive expert advice, important local updates, and insider knowledge on the best ways to thrive in this unique region. Whether you're buying, selling, or simply curious about life in the Pacific Northwest, I've got you covered.

👉 Join my newsletter today and never miss a beat! Just enter your email below and get exclusive access to all things Southwest Washington. Let’s stay connected!

Frequently Asked Questions

What is a red flag when buying a house?

Major structural issues like foundation cracks, roof damage, or signs of water intrusion are red flags. Mold, outdated electrical systems, or signs of DIY renovations without permits can also signal future headaches. Always pay attention to the home inspection report—it often tells the real story.

What part of Vancouver, WA is the best to live in?

Popular areas include Felida, Fishers Landing East, and Camas for their great schools, safety, and newer homes. Downtown and the Vancouver Waterfront offer more walkability and urban living with scenic views. The "best" area depends on your lifestyle—families, retirees, and commuters each value different things.

What are at least 5 don'ts when buying a home?

Don’t open new credit lines or make large purchases before closing. Don’t skip the home inspection. Don’t forget to budget for closing costs, property taxes, and maintenance, and don’t rely solely on online listings—work with a trusted local real estate expert.

What purchases should I avoid when buying a house?

Avoid buying new cars, furniture, or anything that requires financing or impacts your credit score. Large cash withdrawals or deposits can also raise red flags with your lender. Hold off on splurges until after you close.

What is the biggest red flag in a home inspection?

Foundation issues are often the biggest and most expensive red flags. Other major concerns include roof damage, electrical hazards, plumbing leaks, and signs of mold or pests. If a home inspector recommends further evaluation by a specialist, take it seriously.

How to know when not to buy a house?

If the house needs costly repairs you can’t afford, is overpriced for the neighborhood, or fails inspection with major safety issues—it’s a no-go. Also avoid homes with title issues or those that stretch your budget too thin. If you feel rushed or pressured, trust your gut—it’s okay to walk away.

What is the safest neighborhood in Vancouver, WA?

Felida, Fishers Landing East, and parts of Camas are considered among the safest areas, with low crime rates and strong community involvement. These neighborhoods offer great schools and well-maintained homes. Safety reports and local police data back this up.

What is the best neighborhood for retirees in Vancouver, WA?

Cascade Park, East Minnehaha, and Felida are popular with retirees for their quiet streets, proximity to healthcare, and access to shopping. 55+ communities and low-maintenance housing options are common in these areas. Vancouver’s mild climate and no state income tax also make it retirement-friendly.

What are winters like in Vancouver, Washington?

Winters in Vancouver are mild, rainy, and cloudy, with average highs in the 40s and 50s. Snow is rare but possible—usually light and short-lived. The area gets more rain than snow, so waterproof gear and good indoor lighting are essentials.

What not to do financially before buying a house?

Don’t open or close credit cards, take out new loans, or make large deposits without documentation. Avoid changing jobs or making inconsistent income moves unless absolutely necessary. Lenders want to see stability—any big financial changes can delay or derail your loan approval.

Categories

Recent Posts

GET MORE INFORMATION

Cassandra Marks

Realtor, Licensed in OR & WA | License ID: 201225764

Realtor, Licensed in OR & WA License ID: 201225764