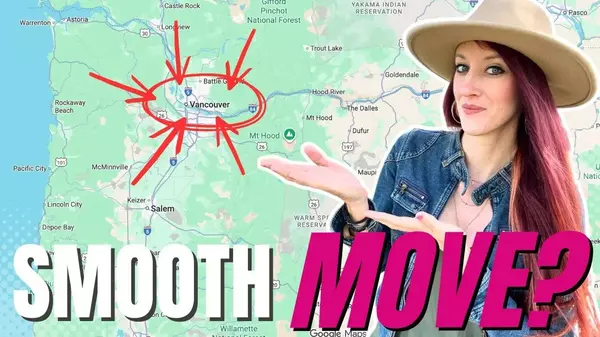

5 Financial Pros and Cons to Owning a Home in Vancouver, Washington

5 Financial Pros and Cons to Owning a Home in Vancouver, Washington

Are you at that crossroads where homeownership beckons, and Vancouver, Washington, emerges as a potential haven for your future? If so, you're on the verge of a life-changing and significant financial decision. Let's dive into the five financial pros and five financial cons of owning a home in the Vancouver real estate market.

Financial Pros of Homeownership

Let's start with the positive side of the spectrum because who doesn't love some good news when it comes to finances?

-

Building Equity: A Forced Savings Account

Vancouver's housing market has been steadily appreciating, offering homeowners a unique advantage. Owning a home means building equity over time. With national appreciation averaging 4% year over year, that's about $20,000 of equity on a $530,000 home.

-

Tax Advantages: Keeping More in Your Pocket

Washington state provides several tax benefits for homeowners. Deducting mortgage interest and property taxes from your annual income can significantly reduce your tax liability. If you work from home, the ability to deduct a home office adds another layer of financial advantage.

-

Stable Housing Costs: Predictability in Monthly Payments

Unlike renters facing the uncertainty of rising rents, homeowners with fixed-rate mortgages enjoy stable and predictable monthly payments. This predictability simplifies budgeting, providing peace of mind amidst changing economic conditions.

-

Potential for Rental Income: A Lucrative Option

Vancouver's thriving tourism industry opens up opportunities for homeowners to explore the short-term rental market, such as Airbnb. Additional income streams can help cover mortgage payments and boost overall cash flow. Get creative with potential spaces like mother-in-law suites or basements for additional rental income.

-

Long-Term Financial Security: A Pillar for Retirement

Homeownership contributes to long-term financial security. Once your mortgage is paid off, you'll have a substantial asset and reduced housing expenses in retirement. Until then, the equity gained each year can be leveraged for other ventures or used in times of need.

Financial Cons of Homeownership

Now, let's address the challenges and financial considerations that come with owning a home.

-

Initial Costs: The Upfront Financial Hurdle

While homeownership is an investment, it often requires substantial upfront costs. Down payments, closing costs, and various fees can be a financial hurdle for first-time buyers. Fortunately, there are opportunities with some programs allowing for as low as 3% down, depending on qualifications.

-

Ongoing Maintenance and Repairs: A Continuous Financial Commitment

Homes demand continual maintenance and repairs, from leaky roofs to malfunctioning HVAC systems. These unexpected expenses can strain finances, emphasizing the need for a robust budget. Renters may prefer avoiding such responsibilities.

-

Paying Property Taxes and Insurance: Additional Financial Burden

Beyond the mortgage, homeowners are responsible for property taxes and insurance. These costs vary based on location and can significantly add to the financial burden of homeownership. Stay informed about potential increases in property taxes due to local votes on items like school levies.

-

Limited Mobility: Selling Challenges in Competitive Markets

Homeownership can limit mobility, particularly in competitive markets like Vancouver's. Selling a home takes time, making it challenging to seize new job opportunities or respond to unexpected life changes. A competent realtor familiar with market dynamics can help navigate this challenge.

-

Market Risks: Vulnerability to Fluctuations

Despite Vancouver's generally robust real estate market, it's not immune to fluctuations. Economic downturns can lead to temporary decreases in property values, impacting equity and overall financial situations. With the average homeowner staying in their home for 7-10 years, there's a chance to recover equity over time.

While the pros and cons provide a broad overview, there are other factors to consider when delving into homeownership in Vancouver. LOCAL TIP: As someone who lives here and has purchased homes here, I believe that the best time to purchase a home is in the winter but that is a topic for another blog.

Ultimately, homeownership in Vancouver, Washington, can be a wise financial decision, but understanding both sides of the coin is crucial. If you want to delve deeper into these considerations or learn more about living in Southwest Washington. Your personal financial situation, goals, and lifestyle will determine whether homeownership in Vancouver aligns with your vision. Cheers to your home ownership adventure and maybe we can take that adventure together!

Sign up for my monthly newsletter to receive expert advice, important local updates, and insider knowledge on the best ways to thrive in this unique region. Whether you're buying, selling, or simply curious about life in the Pacific Northwest, I've got you covered.

👉 Join my newsletter today and never miss a beat! Just enter your email below and get exclusive access to all things Southwest Washington. Let’s stay connected!

Frequently Asked Questions

What is the average price of a house in Vancouver WA?

As of 2025, the average home price in Vancouver, WA is approximately $525,000, though prices vary by neighborhood and housing type.

How much do you need to make to own a home in Vancouver?

To afford a median-priced home in Vancouver with a conventional loan, most buyers need to earn between $90,000 and $110,000 annually, depending on down payment and debt.

Is living in Vancouver, WA worth it?

Yes. Vancouver offers a mix of affordability, access to Portland, outdoor recreation, and no state income tax, making it a popular spot for families, retirees, and remote workers.

What is the average cost of a home in Vancouver?

The average cost aligns with the median—typically between $500,000 and $550,000. Entry-level homes may start around $400,000.

What is the mortgage rate in Vancouver WA?

Mortgage rates in Vancouver typically follow national averages. As of mid-2025, most buyers are seeing rates around 6%–6.5% for a 30-year fixed loan.

What is the most expensive neighborhood in Vancouver, WA?

Felida, East Minnehaha, and the Columbia River waterfront area are among the most expensive, with homes often priced at $1 million or more.

What income do you need for an $800,000 mortgage?

Assuming average debt and a standard 30-year fixed mortgage at current rates, you’d need an annual household income of at least $140,000–$160,000.

Is it cheaper to buy or make your own house?

Building a home in Vancouver can be more expensive than buying an existing one, depending on land cost, materials, and labor. However, it may be worth it for custom features or energy efficiency.

What salary do you need for a $450,000 mortgage?

To qualify for a $450,000 mortgage, most lenders require an income of at least $80,000–$95,000 annually, assuming average debt and credit.

What is a good salary in Vancouver, WA?

A good salary in Vancouver is typically considered $75,000 or higher, allowing for a comfortable lifestyle with some room for savings and homeownership.

Categories

Recent Posts

GET MORE INFORMATION

Cassandra Marks

Realtor, Licensed in OR & WA | License ID: 201225764

Realtor, Licensed in OR & WA License ID: 201225764