The Hidden Risks in Your Homeowners Insurance Policy

The Hidden Risks in Your Homeowners Insurance Policy

When Was the Last Time You Read Your Homeowners Insurance Policy?

Let’s be honest—most people don’t think about their homeowners insurance policy until something goes wrong. But here’s the hard truth: homeowners insurance in Vancouver, Washington, is changing rapidly. If you’re not paying attention, you could end up underinsured—or worse, uninsurable. And trust me, I’ve seen it happen firsthand.

As a homeowner, investor, and real estate professional, I’ve had my fair share of experiences with homeowners insurance—from handling claims to watching policies evolve. So, let’s dive into what’s happening and how you can protect yourself and your home.

Why Is Homeowners Insurance Getting More Expensive?

If you’ve noticed your homeowners insurance premium creeping up (or skyrocketing), you’re not alone. Insurance rates are climbing nationwide, and Washington is no exception. Here’s why:

-

Rising construction costs – Building materials and labor aren’t getting any cheaper, and insurers are adjusting their policies accordingly.

-

More frequent claims – From severe weather events to everyday mishaps, insurance companies are paying out more than ever before.

-

Natural disasters – While we might not get hurricanes like the East Coast, wildfires, floods, and the occasional earthquake are real risks here.

-

Insurance companies pulling out – Some insurers are simply opting out of certain areas altogether, making it harder (and pricier) for homeowners to find coverage.

What to Watch for in Your Policy?

Not all homeowners insurance policies are created equal, and unfortunately, many people don’t realize they have coverage gaps until they file a claim. Here are a few things to keep an eye on:

1. Rising Premiums

Expect your premiums to increase annually—especially if you haven’t reviewed your policy in a while. Inflation, increased risks, and market conditions all contribute to higher costs.

2. Coverage Gaps

Did you know standard policies often don’t cover water damage from floods, landslides, or certain windstorms? You might need additional endorsements to get full protection.

3. Higher Deductibles

Many insurers are raising deductibles, meaning you’ll be paying more out of pocket before your coverage kicks in. Double-check your policy to see what you’re on the hook for if disaster strikes.

4. Limited Provider Options

With some insurers scaling back in high-risk areas, finding coverage isn’t as simple as it used to be. If you’re in the market for a new home, checking insurance options before making an offer is crucial.

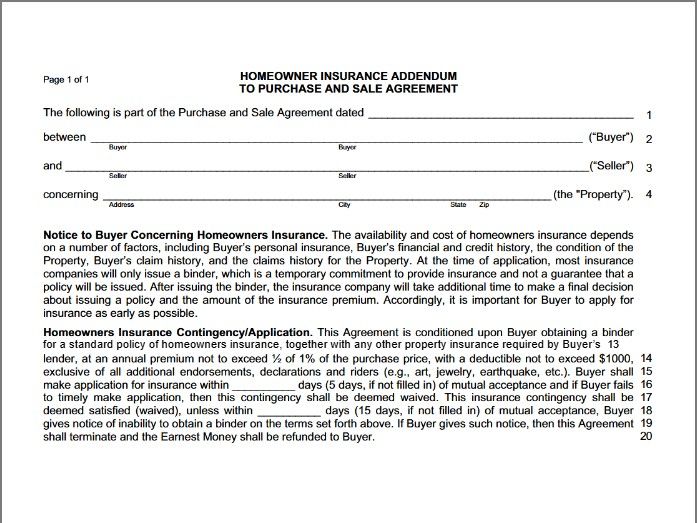

The 22VV Homeowners Insurance Addendum for Buyers

If you’re buying a home in Washington, you should know about the 22VV addendum—an important contingency that allows buyers time (usually about 10 days) to shop for homeowners insurance before finalizing their purchase.

If you’re buying a home in Washington, you should know about the 22VV addendum—an important contingency that allows buyers time (usually about 10 days) to shop for homeowners insurance before finalizing their purchase.

Why is this a big deal? Imagine you get a quote for $10,000 a year when you were expecting $2,000 or $3,000. Yikes. The 22VV allows you to back out of the transaction if the cost of insurance is too high. I’ve personally used this addendum for clients when insurers refused coverage due to roof issues—and trust me, no one wants to be stuck replacing a $20,000 roof within 90 days of closing.

Do You Need Flood Insurance in Vancouver?

Vancouver, Washington, sits near the Columbia River, which means certain areas are flood-prone. But here’s the kicker—standard homeowners insurance does not cover flood damage. If you want flood protection, you’ll need a separate policy through the National Flood Insurance Program (NFIP) or a private provider.

Even if your home isn’t in a designated flood zone, checking FEMA flood maps and discussing your options with an insurance expert is a smart move. Trust me, it’s better to know your risks before the water starts rising.

What About Earthquake Insurance?

We’re not California, but we are in an active seismic zone. While major earthquakes are rare, they can happen. That said, earthquake damage is NOT covered under standard homeowners insurance policies.

If you want earthquake coverage, you’ll need to purchase a separate policy. Just be aware that these policies often come with super high deductibles. Is it worth it? That depends. If your home is older or built on soft soil, it might be a good investment. But personally, I’ve lived here for years and haven’t experienced an earthquake yet (knocking on wood as I type this!).

The Bottom Line: Don’t Skimp on Your Policy

Homeowners insurance isn’t a one-size-fits-all deal. If you own a home in Vancouver—or are planning to buy one—here’s what you need to do:

-

Review your policy annually – Call your insurance provider at least every other year to make sure your coverage aligns with your home’s current value, renovations, and major purchases.

-

Understand what’s covered and what’s not – Consider additional coverage for floods, earthquakes, and other specific risks.

-

Work with a trusted insurance provider – Get multiple quotes and ensure your policy provides the protection you actually need.

-

Do not skimp on coverage – Saving a few bucks upfront could cost you big in the long run.

One Last Story…

Back when I was working for a restoration company in Denver, we had a hailstorm with softball-sized hail (yes, you read that right). One investor I knew owned six rental properties and had cut corners on his insurance policies. While he had a reasonable $1,000 deductible for general claims, he didn’t realize his roof deductible was $5,000 per property. That meant he had to cough up $30,000 out of pocket to replace the roofs. Ouch.

Moral of the story? Know your policy. Read the fine print. Ask questions.

Final Thoughts

Homeowners insurance is one of those things that’s easy to ignore—until you desperately need it. Staying informed and proactive can save you thousands of dollars (and countless headaches) down the road.

So, Vancouver homeowners: take some time this week to review your policy. If you’re in the market for a new home, make sure you factor insurance costs into your budget. And if you have questions? Find a knowledgeable insurance agent who can guide you through the process.

Because when it comes to protecting your home, an ounce of prevention is worth a pound of repair bills.

Sign up for my monthly newsletter to receive expert advice, important local updates, and insider knowledge on the best ways to thrive in this unique region. Whether you're buying, selling, or simply curious about life in the Pacific Northwest, I've got you covered.

👉 Join my newsletter today and never miss a beat! Just enter your email below and get exclusive access to all things Southwest Washington. Let’s stay connected!

Frequently Asked Questions

How much is homeowners insurance on a $500,000 house?

Homeowners insurance for a $500,000 home typically costs between $1,500 and $3,000 annually, depending on your location, coverage, deductible, and insurer. Areas with high wildfire, flood, or storm risk may see higher premiums. Discounts for bundling, security systems, or new roofs can help reduce the cost.

Which insurance is best for house insurance?

The best homeowners insurance depends on your needs, location, and budget. Highly rated companies include State Farm, Allstate, Amica, Nationwide, and USAA (for military families). Look for an insurer with strong customer service, competitive pricing, and comprehensive coverage options.

What is the most common home insurance coverage?

The most common type is an HO-3 policy, which covers your home against all perils except those specifically excluded. It typically includes dwelling coverage, personal property, liability protection, and loss of use. Optional add-ons like flood or earthquake insurance may be needed based on where you live.

Which is the best home insurance policy?

The best policy is one that fully protects your home, belongings, and liability risks at a price you can afford. HO-5 policies offer broader protection than HO-3, especially for high-value items. Make sure your policy includes replacement cost coverage and meets any lender requirements.

How much is insurance on a $300,000 home?

For a $300,000 home, homeowners insurance generally costs between $1,000 and $2,000 annually. Prices vary widely based on state, coverage level, deductible, and home characteristics. Location-specific risks like earthquakes or flooding can significantly affect premiums.

Who has the cheapest homeowners insurance?

Companies like State Farm, Progressive, and Farmers often offer competitive rates, but the cheapest depends on your location and home details. Online tools can help compare personalized quotes. Bundling with auto or umbrella policies typically lowers the cost.

Who has the best homeowners insurance?

Companies frequently ranked best for service and reliability include Amica, USAA (if eligible), State Farm, and Chubb. The "best" provider balances price, claims satisfaction, and tailored coverage. It's important to compare quotes and reviews for your region.

What is a normal amount to pay for home insurance?

Nationally, the average homeowner pays between $1,200 and $1,800 per year. That number can go up or down based on your home’s value, location, deductible, and coverage options. Older homes or those in high-risk areas may cost more to insure.

Is Progressive home insurance good?

Progressive offers solid homeowners insurance through third-party underwriters and is known for competitive pricing and bundling discounts. Customer satisfaction varies by provider and location. It's a good idea to compare Progressive quotes with other major carriers.

Can I lower my homeowners insurance?

Yes—raising your deductible, improving home security, bundling with auto insurance, or upgrading your roof or plumbing can reduce premiums. Ask your insurer about all available discounts. Shopping around and comparing quotes yearly can also lead to savings.

Categories

Recent Posts

GET MORE INFORMATION

Cassandra Marks

Realtor, Licensed in OR & WA | License ID: 201225764

Realtor, Licensed in OR & WA License ID: 201225764